Remuneration of the Vice-Chancellor & President of King's

How the Vice-Chancellor & President's remuneration is calculated and structured.

The university is committed to providing transparency and clarity on its finances and how the income we earn is used to further King’s services and ambitions.

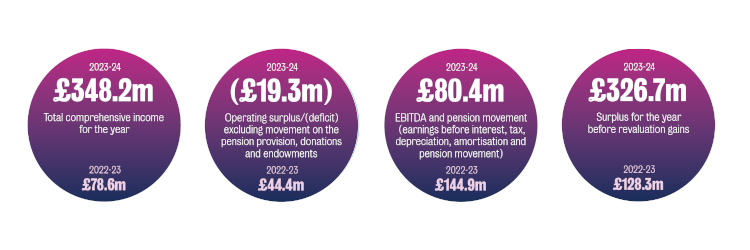

The financial statements for the year ended 31 July 2024 show an extraordinary surplus of £327m for the year.

Of this, £323m related to the change in the financial position of the Universities Superannuation Scheme (USS). As USS is no longer in deficit, King’s does not have to show the value of contributions in the future to the USS deficit.

This is a non-cash movement and has no impact on our budgeting. Removing the effect of the USS movement, King’s income increased by £40m (+3%) to £1,270m and our expenditure increased £109m (+9%) to £1,266m – leaving an operating surplus of £4m.

We usually then take out the income received as donations, which would produce a true deficit on operations of £19m. The combination of a 3% increase in income and a 9% increase in expenditure explains the relative decline in our financial results compared with 2022-23.

Our financial strategy is to earn operating surpluses that will grow over time, to be able to invest in our academic future for the benefit of our students and colleagues and to maintain and enhance our physical and digital infrastructure.

Our financial target for the current financial year is a higher surplus than 2023–24.

Our recruitment of students in 2023 was below our plans and meant that tuition fee income was £40m below our target. While this reflected the experience of many other universities, it represented a significant income shock.

The 2024 student recruitment was considerably stronger, and we believe that we will be very close to our financial income targets for tuition fees.

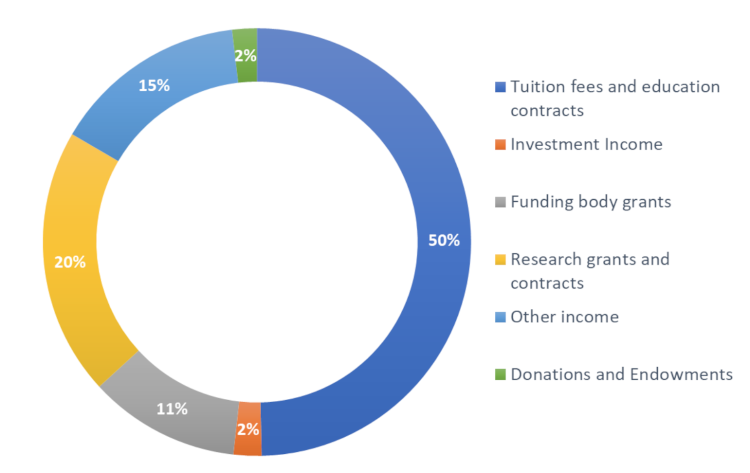

Research income reached £257m in 2023–24, an increase of 9% on 2022–23. We were successfully awarded £293m in new grants and contracts, a £13m increase on the previous year.

This growth continues the trends of the last three years and offers positive signs for the future.

Relative income contributions from different activities:

Expenditure increased by £109m or 9%. The main reason was an increase of over 10% in the costs of salaries and wages – reflecting the higher national pay award, King’s decision to increase the London Weighting by £1,000 and an increase of around 4% in staff numbers.

King’s has built up a substantial endowment fund from generous philanthropic gifts over our long history.

We seek to generate income from the fund to support current expenditures in line with the donor’s intentions, and also maintain the real value of the funds, so that the annual income stream can be maintained in the future.

The University invests its endowments in managed funds run by professional investors and not directly into individual companies.

In 2023-24, our Endowment Asset investments increased by £24m, from £301m to £325m.

King’s maintains and regularly reviews our ethical investment policy, which was most recently updated on 18 November 2024.

King’s specifically invests in funds that proactively screen to avoid controversial and unethical sectors and industries – like tobacco, controversial weapons and fossil fuels. The university invests in funds that actively target positive social and green investments.